Our nation’s Social Security system provides benefits to more than 59 million Americans, including over 11 million people with disabilities. It ensures individuals and family members for when a worker retires, dies, or acquires a qualifying disability. It was created in 1935 to provide a safe, efficient system of insurance for American workers and their families.

Social Security is an earned benefit with dedicated funding from payroll contributions paid by workers and their employers (also known as the FICA tax). Generally, to be covered a worker must have worked for long enough and recently enough, and earned enough, to have sufficient FICA credits– typically, 40 quarters about 10 years. Benefits are based on the worker’s earnings history and are generally modest, averaging a little over $1,200 per month for all beneficiaries.

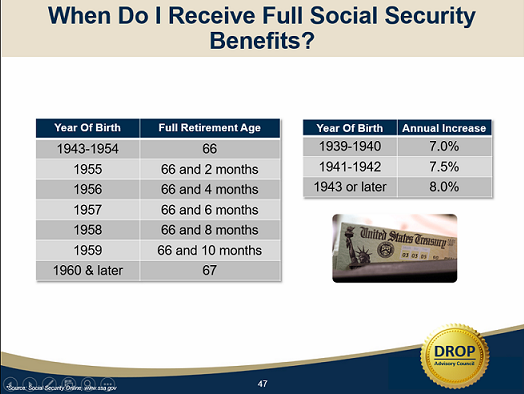

When you should begin to withdraw your Social Security benefits? It will depend largely on your current and future financial situation. The earliest you can begin drawing your benefits is at age 62, but it is important to know that you will only be getting 75% of your total benefits if you begin drawing that early. If you are able to hold off on drawing your benefits until you reach full-retirement age, then you will receive 100 percent of your total benefits. Also, each year you hold off on drawing your benefits, the lifetime benefit increases 8 percent every year until you reach age 70.

When you should begin to withdraw your Social Security benefits? It will depend largely on your current and future financial situation. The earliest you can begin drawing your benefits is at age 62, but it is important to know that you will only be getting 75% of your total benefits if you begin drawing that early. If you are able to hold off on drawing your benefits until you reach full-retirement age, then you will receive 100 percent of your total benefits. Also, each year you hold off on drawing your benefits, the lifetime benefit increases 8 percent every year until you reach age 70.

Another important thing to keep in mind, if you are going to continue to work and start taking Social Security benefits early — before full retirement age — you can be charged a penalty if you wind up making too much money.

Special Earnings Limit Rule

Some people who retire in mid-year have already earned more than their yearly earnings limit. That is why we have a special rule that applies to earnings for one year, usually the first year of retirement.

The special rule lets us pay a full Social Security check for any whole month we consider you retired, regardless of your yearly earnings. If you will:

- Be under full retirement age for all of 2019, you are considered retired in any month that your earnings are $1,470 or less and you did not perform substantial services in self employment.

- Reach full retirement age in 2019, you are considered retired in any month that your earnings are $3,910 or less and you did not perform substantial services in self-employment.

Example: John Smith retires at age 62 on June 30, 2019. He earned $37,000 before he retired.

On October 5th, John starts his own business. He works at least 15 hours a week for the rest of the year and earns an additional $3,000 after expenses. His total earnings for 2019 are $40,000.

Although his earnings for the year substantially exceed the 2019 annual limit ($17,640), John will receive a Social Security payment for July, August, and September. This is because he was not self-employed and his earnings in those three months are $1,470 or less per month, the limit for people younger than full retirement age.

John will not receive benefits for October, November or December 2018 because he worked in his business over 45 hours per month in all three months.

Beginning in 2020, the deductions are based solely on John’s annual earnings limit.